What is this Indexing Thing?

If you have been following this newsletter for any period of time, or if you follow the financial industry, you have probably come across the term, “indexing.” Now I could write a 2,000 word document going over the intricate details of how it works, how the companies can afford to do it, all the different strategies and many other details like that. However, I am not trying to put you to sleep or confuse you. Instead, I am going to keep it simple and tell you everything you need to know.

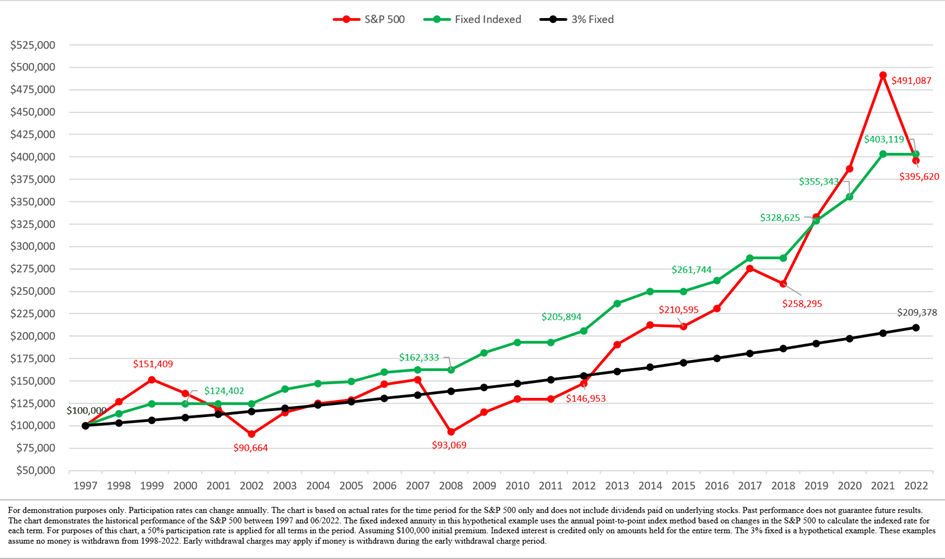

So what is Indexing? Simply put, indexing is a strategy used to grow money you are putting away for your future. We call it indexing because the growth/interest you gain is tied to an index, not directly invested. Most commonly, they are tied to the S&P 500, but it could be the DOW, a foreign exchange or something else entirely. It all depends on what is offered by the issuing company. The cool thing is that because it is tied to an index, you capture the gains of the market but you are protected from suffering its losses. The only thing that affects your growth is the cap rate of the product, the participation rate, or the spread. I will only be covering the most common strategy, the cap rate. So let’s look at an example.

Let’s say you have an indexed product, and the cap on your product is 10%. So what that means is that whatever the market does, you get that percentage up to 10%, but remember, you are protected against all losses. We will compare it to regular investments with both investments starting at $100,000.

So, after 5 years which would you rather have? But there’s a problem with this example. In a regular investment you have fees, right? There are transaction and annual management fees, that you don’t have with an indexed investment! According to reports by Morningstar, they average around 3%. So if you add in the 3% fee each year… You will net 14%, 4%, , -23%, 17%, and 9% respectively. This will bring your new total to $119,487. Now how much better off are you? That is the power of indexing!

Like more info or a strategy call – reach out!