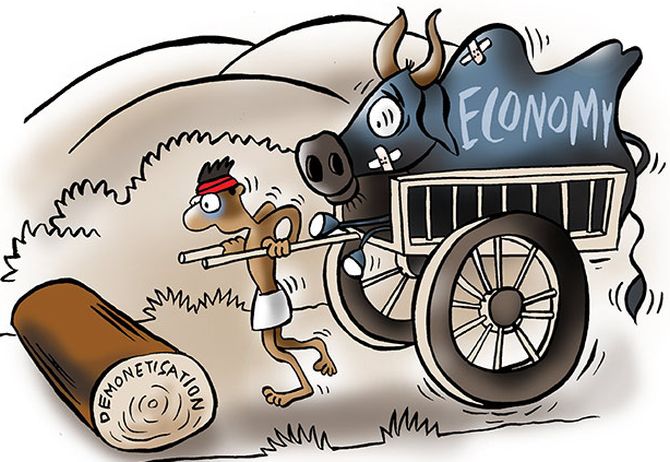

How Will You Survive if the Economy is a lot Worse in 2023?

In the past week, I have spent many hours reading articles on what the experts think will happen in the economy in 2023 and 2024. Some experts say there is a 100% chance of a recession! Others say only a 60% chance of a recession! Whether or not we have a recession, the problem is we still have high inflation and increased energy costs. Many families are having a hard time just finding the money they need to survive. So, consumer sales are down. What can and should you do to make sure you will survive for the next two years?

Big Companies Are Already Laying Off Their Employees…

• DoorDash layoffs: 6% of the workforce laid off (November 2022)

• Candy Digital layoffs: 33% of the workforce laid off (November 2022)

• Amazon layoffs: 1% of the workforce laid off beginning (November 2022)

• Twitter layoffs: 50% of the workforce laid off (November 2022)

• Zillow layoffs: 5% of workforce laid off (October 2022)

• Peloton layoffs: 12% of the workforce laid off (October 2022)

• DocuSign layoffs: 9% of the workforce laid off (September 2022)

• Snapchat layoffs: 20% of the workforce laid off (September 2022)

• Ford Motor Company layoffs: 6% of the workforce laid off (August 2022)

And from what I have read this is just the start of the layoffs from big companies like the major Banks, Real Estate Firms, Grocery Chains, Etc.

Grocery Chains Are Closing Locations for Good Right Now – Whole Foods Market, Kroger, Sprouts Farmers Market, Walmart, Piggly Wiggly, Winn Dixie, and Food Lion… Just to name a few.

Are You Using Credit Cards To Find The Money You Need To Survive!

According to LendingTree — “Americans’ total credit card balance is $925 billion in the third quarter of 2022, according to the latest consumer debt data from the Federal Reserve Bank of New York. That’s a $38 billion jump from $887 billion in the first quarter of 2022.

Since the third quarter of 2021, credit card balances have risen by $121 billion. That’s a 15% increase, the largest year-over-year jump in more than 20 years.

With the increase, Americans’ credit card debt stands just $2 billion below the record set in the fourth quarter of 2019, when balances stood at $927 billion. Thanks to rising interest rates, stubborn inflation, and myriad other economic factors, it’s likely just a matter of time before credit card balances surpasses the 2019 record.

Though balances aren’t quite at record levels yet, they’re still light years above the $480 billion seen more than 20 years ago in the first quarter of 1999.”

The Question Is How Will You Survive In 2023 and 2024?

Consider, many families are already having a hard time finding the money to put food on the table and heat their homes!

The best thing you can do today is to be better at managing your debt. Reducing and eliminating debt is the best way for you to find the money to make it through this economic crisis!

Do you have money in investments, banks, and insurance policies, that you can use to pay down or off credit cards and loans? Does it make any sense to be paying 17% or higher interest on credit cards? When you only earn 4-6% returns on the money you have in savings and investments?

Can you consolidate your loans or credit cards for a lower monthly payment?

Do you have equity in your homes that you can use to pay off credit cards and loans? Does it make any sense to be paying 17% or more interest on credit cards? When you can refinance your home, or take out an equity line of credit? Won’t the interest rate be a lot less than the 17% or higher interest you pay on your credit cards?

What Else Can and Should You Do To Survive?

Can you review your monthly expenses to find the money you are spending in the wrong places or on the wrong things?

Do you have low deductibles on the homeowners and auto policies? Do you have unneeded riders on the policies? Would increasing deductibles on your policies lower your monthly payments?

Could you take some of the money in your savings to pay off car loans? Or pay off any other loans you may have? How much money would that save you every month?

There are a lot of things you can do to reduce your monthly expenses! And you should take the time to do it now before it is too late.

We have seen many cases where people (middle-income families) cut their monthly expenses by $1,000, $2,000, or more! Would that help you to survive in this struggling economy?